Financial Knowledge You Can Use

Explore expert insights, planning tools, and helpful resources to make confident financial decisions

Frequently Asked Question

We provide investment advisory and financial planning services, structuring prudent fiduciary processes around planning and investment management. Our relationship is guided by two key documents: the Financial Plan and the Investment Policy Statement (IPS).

As a fiduciary, we are legally and ethically obligated to always put our clients' interests first. This means we provide transparent, unbiased advice and fully disclose any potential conflicts of interest.

Unlike brokers or registered reps who may not be held to a fiduciary standard, we are fee-only and independent—ensuring all advice is in your best interest.

No. Your assets are held by a third-party custodian who executes transactions, provides reporting, and safeguards your accounts.

TCI = Custodian Fees + Investment Fees + Advisor Fees. We help you understand and minimize the true total cost of managing your investments.

We monitor your plan and IPS regularly and meet with you at least once per year—or more often, as needed—to keep everything aligned with your goals.

Simply schedule a call with us to discuss your financial goals. We’ll help determine how our services can best support your long-term success.

Right Decision Financial Planning does not accept commissions or fees of any kind from any firm, fund or investment that we recommend.

Typically we charge either:

- An investment advisory fee; based on AUM (assets under management)

- An agreed upon flat fee, based on your individual planning needs

Right Decision Financial is truly independent. We only get paid by our clients.

We are not affiliated with and we do not receive any compensation from any financial institution or investment we may recommend.

You and You living your best life… is our only concern

We act as an ERISA* fiduciary. By law, we must put our client’s interest before the firm’s.

*The Employee Retirement Income Security Act of 1974 (ERISA)

What does it cost to invest?

TOTAL COST OF INVESTING (TCI)

To calculate your TCI, we need to include the fees and expenses of the following three elements.

-

CUSTODIAN $

A custodian is a financial institution that holds customers’ securities and cash for safekeeping in order to minimize risk. Custodians can be banks, trust companies or broker dealers.

-

INVESTMENTS $

An investment is an asset or item acquired with the goal of generating income or appreciation. Typical investments include exchange traded fund (ETF), mutual fund (Funds) and individual equities (Stocks).

-

ADVISOR $

The advisor is the person or company that assists in identifying the types of accounts you need, the amount of money to save, the kinds of insurance you require, how to invest and assists with estate and tax planning.

EXAMPLE TCI & PERFORMANCE

Below are a few samples of Right Decision Target allocations, click on the Allocation to get the underlying Portfolios’ Hypothetical Performance and Cost report. See what the cost and performance of $10,000 might have been, if you had a commission free account managed by Right Decision Financial Planning.

HYPOTHETICAL RISK & RETURN

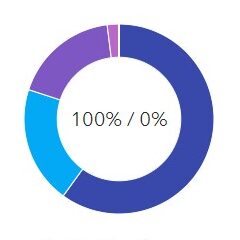

RDFP Most Aggressive

This hypothetical strategy demonstrates our low cost for an initial investment of $10,000 with a target for aggressive growth over a ten year period.

Total Cost

HYPOTHETICAL RISK & RETURN

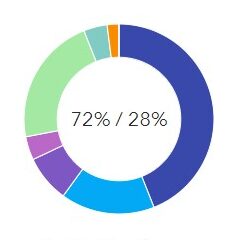

RDFP Growth

This hypothetical strategy demonstrates our low cost for an initial investment of $10,000 with a target for moderate growth over a ten year period.

Total Cost

Investment Options

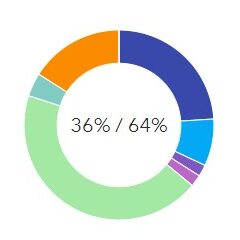

HYPOTHETICAL RISK & RETURN

RDFP Growth

This hypothetical strategy demonstrates our low cost for an initial investment of $10,000 with a target for conservative growth over a ten year period.

Total Cost

Investment Options

Are you ready to live your best life?

At RDFP, we are committed to guiding you through every financial stage of life with customized, client focused strategies