Custody of Assets

Why we Don't Custody our Clients' Assets

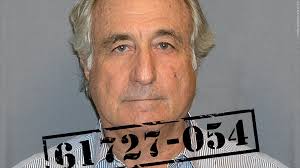

In one word: “Madoff”

The simple fact is that fraudsters have been around forever.

We encourage everyone looking to hire an investment advisor to review this: SEC Investor Bulletin: Custody of Your Investment Assets

How custody works:

- You will open an account with your chosen custodian. RDFP can help setup your account, but only you will know your user ID and password. RDFP will never ask for them.

- You will then request that RDFP be added as an investment advisor, authorizing RDFP to buy and sell securities in your account on your behalf.

- You will then choose whether to authorize the custodian to deduct the amount of RDFP’s advisory fees from your account, which will be reflected on your account statement or to have RDFP bill you directly.

- You then fund your account by sending a check to the custodian or transferring old accounts into your new account (rollover). You will never be asked to fund or add to your account by sending or depositing: checks, wires, rollovers, cryptocurrency or any other type of cash to MVM or accounts controlled by MVM.

- You will receive, at a minimum, quarterly account statements from your custodian; independent of any reports produced by RDFP.